Certificates of Deposit (CDs)

Certificates of Deposit (CDs) Certificates of deposit offer a safe, guaranteed rate of return, with a variety of maturity dates to coincide with your needs. Our CD terms range from 3 month to 5 years. See the most up to date terms and rates for our accounts by clicking on the current rates. Certificates of deposit are time deposit accounts that operate on a deadline. Each CD has a term, ranging between three months and 60 months. The CD earns interest from the moment it’s funded until the.

- CD Rates Here are the nationally available best CD rates updated daily. Compare these high yield CD rates with confidence because we’re constantly searching the country for the best certificate of deposit interest rates and savings investments.

- Certificate of deposit. 0.7% APY † 3 Yr CD - $10k. National Average. 0.46% APY † 3 Yr CD - $10k. 52% is the difference between the percent earned in interest between FAIRWINDS Credit Union's rate at 0.70% APY compared to 0.46% APY for the National market average over the life of a 3 year certificate of deposit (CD) at $10,000.

Certificates of deposit offer a safe, guaranteed rate of return, with a variety of maturity dates to coincide with your needs. Our CD terms range from 3 month to 5 years. See the most up to date terms and rates for our accounts by clicking on the current rates button below. All of our CDs can be set up as an IRA, contact any of our representatives for details.

We offer three exclusive CD options to all First Federal customers:

|

|

|

Speak with an account representative for more information on Certificates of Deposit, and account disclosures explaining interest calculation.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Open a Chase Certificate of Deposit

You must be an existing Chase checking customer to open online.

Certificate of Deposit FAQ

What is a Chase CD?

A certificate of deposit, or CD, is a deposit account with us for a specified period of time.

What is the minimum deposit amount to open a Chase CD?

$1,000

How is the Chase CD interest calculated?

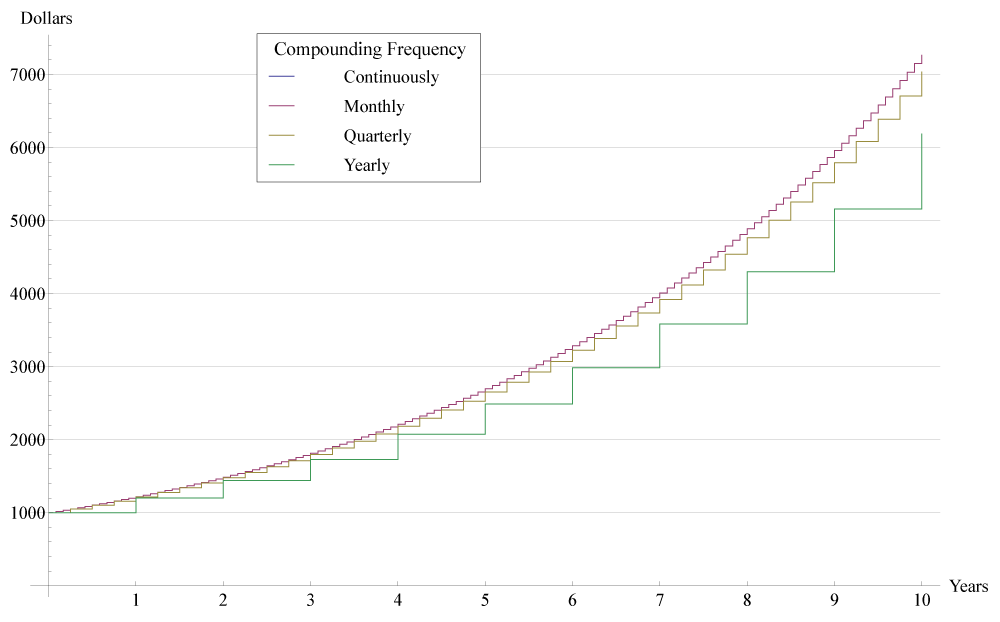

We use the daily balance method to calculate interest on your CD. This method applies a periodic rate each day to your balance. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. On maturities of more than one year, interest will be paid at least annually. Please see the Deposit Account Agreement and rate sheet for further details.

Are there early withdrawal fees or penalties associated with a Chase CD?

There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs:

- If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the term of the CD is 6 months to less than 24 months, then the early withdrawal penalty is 180 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- For terms 24 months or more, the early withdrawal penalty is 365 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the withdrawal occurs less than seven days after opening the CD or making another withdrawal of principal, the early withdrawal penalty will be calculated as described above, but it cannot be less than seven days’ interest.

- The amount of your penalty will be deducted from principal.

See the Deposit Account Agreement and rate sheet for further details

What does it mean when my Chase CD matures?

The maturity date is the last day of your CD’s term. The grace period begins the following day and lasts for 10 days – this is when you can make changes to your CD. Go to chase.com/cdmaturity to learn more about what options you have when your CD matures.

Find a Chase ATM or branch

To find a Chase ATM or branch near you, tell us a ZIP code or an address.

Open a Chase Certificate of Deposit

You must be an existing Chase checking customer to open online.

Certificate of Deposit FAQ

What is a Chase CD?

A certificate of deposit, or CD, is a deposit account with us for a specified period of time.

What is the minimum deposit amount to open a Chase CD?

$1,000

How is the Chase CD interest calculated?

Live roulette bonus. We use the daily balance method to calculate interest on your CD. This method applies a periodic rate each day to your balance. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. On maturities of more than one year, interest will be paid at least annually. Please see the Deposit Account Agreement and rate sheet for further details.

Are there early withdrawal fees or penalties associated with a Chase CD?

There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs:

- If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the term of the CD is 6 months to less than 24 months, then the early withdrawal penalty is 180 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- For terms 24 months or more, the early withdrawal penalty is 365 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the withdrawal occurs less than seven days after opening the CD or making another withdrawal of principal, the early withdrawal penalty will be calculated as described above, but it cannot be less than seven days’ interest.

- The amount of your penalty will be deducted from principal.

See the Deposit Account Agreement and rate sheet for further details

What does it mean when my Chase CD matures?

Certificate Of Deposit Rates Calculator

expandThe maturity date is the last day of your CD’s term. The grace period begins the following day and lasts for 10 days – this is when you can make changes to your CD. Go to chase.com/cdmaturity to learn more about what options you have when your CD matures.

Find a Chase ATM or branch

Certificate Of Deposit Rates 6 Months

To find a Chase ATM or branch near you, tell us a ZIP code or an address.